FXTM Regulation

Exinity Limited is regulated by the Financial Services Commission (FSC) of Mauritius, with an Investment Dealer License number C113012295.

The foremost aim of the FSC is to position Mauritius as a jurisdiction of integrity with a fair balance of regulation and business development. Exinity Limited has been granted an Investment Dealer (Full Service Dealer, excluding Underwriting) Licence pursuant to Section 29 of the Securities Act 2005, Rule 4 of the Securities (Licencing) Rules 2007 and the Financial Services (Consolidated Licencing and Fees) Rules 2008.

Exinity Limited is licensed to offer trading with Forex and CFD products, among other instruments and securities.

FXTM Trading Accounts

Advantage Account: A good account for more experienced traders, spreads start at 0.0 pips on the EUR/USD, which is tighter than other similar brokers, and instead of a spread markup, traders will pay a variable commission of 0.4 – 2 USD per side, depending on volume traded. The minimum deposit on this account is also 500 USD and leverage is set at a maximum of 2000:1.

Advantage Plus Account: The first of two market execution accounts at FXTM, this account is commission-free but spreads start at 1.50 pips on the EUR/USD, which is wider than most other brokers. The minimum deposit on this account is 500 USD and floating leverage is up to 2000:1.

Demo Account: FXTM offers demo accounts for MetaTrader 4, MetaTrader 5, and the FXTM Trader App. Demo accounts are especially important for beginners as they allow them to practice their strategies and get comfortable with the trading platform without risking real money.

The demo account features live quotes and simulates live market conditions in assets such as forex and CFDs on commodities and indices. Once users are up to speed on a demo account, they can easily switch over to a live account.

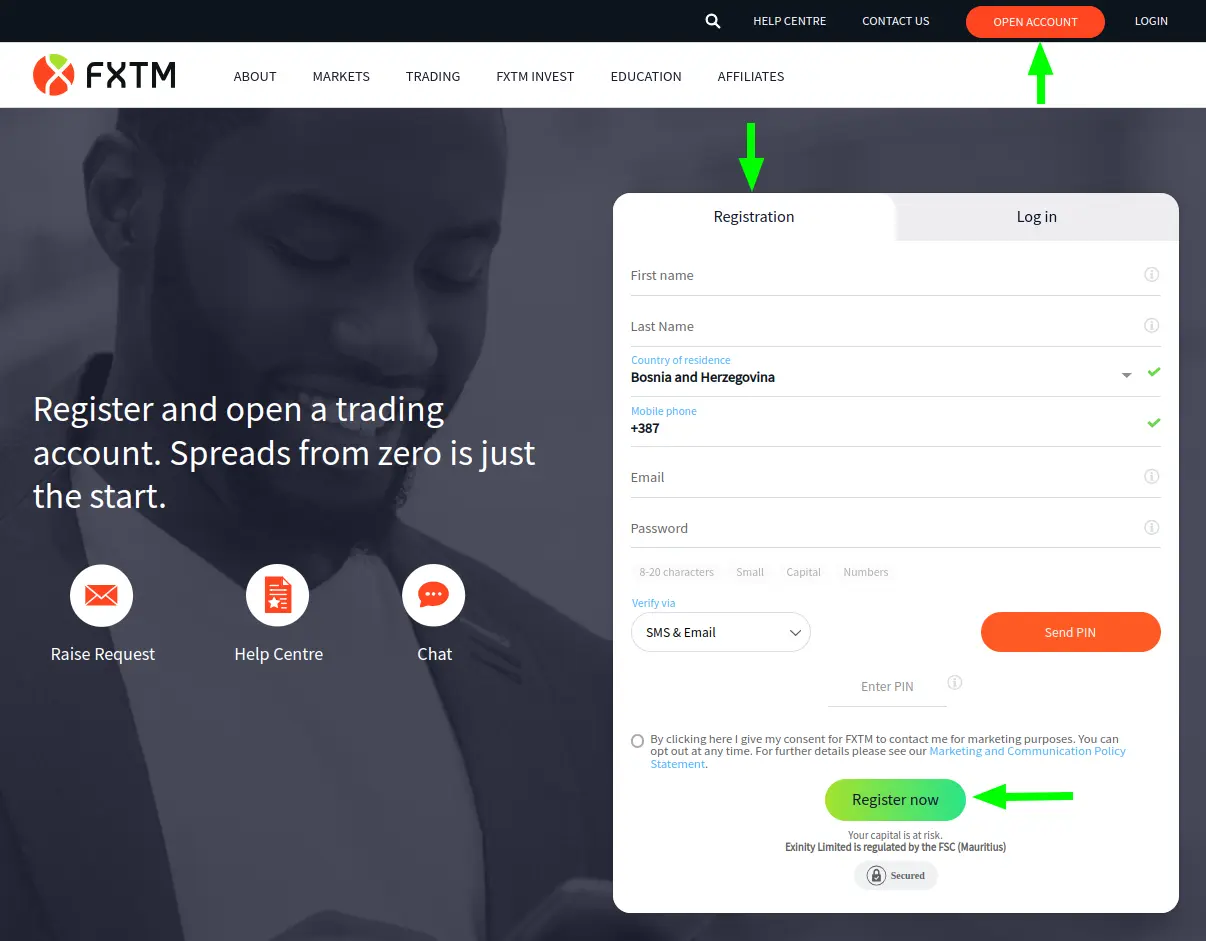

How to Open an Account

- Create a MyFXTM profile

- Choose your account type

- Fund your trading account

- Log in to your MT platform

- Start trading

FXTM Trading Instruments

- Forex: Trade more than 60 currency pairs, including Majors, Minors and Exotics. The maximum leverage on currency pairs is 2000:1. Currency pairs are split into three categories. Major currency pairs are the most traded pairs in the forex industry. They usually include the US dollar as one half of the pair, like the EUR/USD and the USD/JPY. Other commonly traded major pairs include EUR/JPY and the EUR/GBP.

- Metals: Within the metals market, you can trade 4 specific precious metals. These consist of Gold, Silver, Platinum and Palladium. Because of their scarcity and utility in various industries (fashion, art, technology, etc), these are high-demand resources, and strong hedges against market volatility.

- Stocks: Trading stocks with FXTM offers you free access to real time price data on US stocks. You can also trade fractional shares, for example 0.3 of one Apple share, which then turns into a CFD. Stock trading is available on our most popular account type, Advantage and also on Advantage Plus.

- Stock CFDs: FXTM offers 172 stock CFDs to trade, a smaller range than is offered by other similar brokers. Stock CFDs are a type of asset that allow you to trade the price movements of stocks, but you don’t actually own any shares in that company at all. Another advantage is that you can trade with the expectation that a stock’s price will actually fall in value – not just rise. You can’t do this with normal stock trading.

- Commodities: FXTM offers three of the most common spot commodities to trade, including UK Brent, US Crude, and US Natural Gas. Maximum leverage is up to 200:1.

- Indices: An index measures the collective price performance of a group of Shares, usually from a particular country. Indices are often used to track and compare the performance of stock markets. Some of the major indices consist of the Dow Jones Industrial Average, S&P 500, Nasdaq and Russell 3000.

- Cryptocurrencies: Find opportunities in the world’s most volatile markets. Trade bitcoin, ether, ripple and more. Go long or short on bitcoin, ether, ripple and more, with up to 1:100 leverage.

- Trade CFDs: One of the key advantages of CFD trading is that you only need to deposit a small percentage of the total trade value. FXTM CFD traders only require a margin starting from 3 percent. FXTM’s margin calculator is a useful tool to help you to manage your margin on the FXTM Standard account.

FXTM Trading Platforms

FXTM offers two main trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both are popular choices for traders of all experience levels, offering a wide range of features and tools. Here’s a quick breakdown of each:

MetaTrader 4 (MT4):

- Industry standard: The most widely used trading platform globally, known for its stability and reliability.

- User-friendly interface: Easy to learn and navigate, even for beginners.

- Extensive technical analysis tools: Includes a variety of indicators, oscillators, and drawing tools to help you analyze markets.

- Expert Advisors (EAs): Allows you to automate your trading strategies using custom-coded programs.

- Large community and resources: A vast online community provides support, educational resources, and custom indicators.

MetaTrader 5 (MT5):

- More advanced features: Offers additional functionalities compared to MT4, such as built-in market depth, improved backtesting capabilities, and a wider range of order types.

- Modern interface: Sleek and modern design with improved usability.

- Supports more asset classes: Trades not only forex but also stocks, commodities, and futures.

- MQL5 programming language: More powerful and efficient compared to MQL4 for coding EAs.

Mobile Trading:

- FXTM Trader mobile app: Trade on the go with a user-friendly mobile platform.

- FXTM Invest copy trading: Copy the trades of successful traders automatically.

- Educational resources: Free webinars, articles, and videos to help you learn how to trade.

Deposits & Withdrawals

FXTM offers a large number of deposit and withdrawal methods.

Deposit:

- Credit and debit cards: Visa, MasterCard, Maestro

- E-wallets: Skrill, Neteller, PayPal

- Bank wire transfers: Available in various currencies

- Local payment solutions: Sofort, Trustly, iDEAL, Bank Transfer, BPay, POLi, EziPay, Interac, etc. (availability depends on your country)

Withdrawal:

- Withdrawals must be made in proportion to the deposits made according to the payment method used. For example, if you deposited 500 USD using your credit card and 100 USD using Skrill, your first withdrawal of 600 USD must be sent 500 USD to your credit card and 100 USD to your Skrill account.

- You can withdraw funds to the same card, e-wallet, or bank account that you used to deposit.

- Some methods, such as credit cards, may have limitations on how much you can withdraw.

FXTM Awards

FXTM has won multiple international awards from the wider industry, further burnishing its credentials as a secure broker. Recent awards include:

- Best Trading Experience 2020/2019 (World Finance)

- Best European Forex Affiliate Broker Programme 2019 (Global Forex Awards)

- Best Trading Conditions 2019 (World Finance Awards)

- Best investment Broker 2019 (World Finance Awards)

- Best Forex Education Provider Africa 2018 (International Business Magazine)

- Best Trading Conditions 2018 (World Finance).

Customer Support

FXTM offers customer support via live chat, phone, and email during office hours ( Monday to Friday, 6 am to 4 pm GMT / GMT+1 DST). Clients of FXTM are assigned a dedicated customer solutions representative. We rated support at FXTM as reliable and better than average for the industry.

Leave a Reply